A third round of the Paycheck Protection Program (PPP) opened on Jan. 11, prioritizing minority-owned businesses and community lenders. According to the U.S. Small Business Administration (SBA), the new program will give exclusive access to Community Financial Institutions (CFIs) with $1 billion or less in average total assets by providing them exclusive access to the PPP loan portal for at least the first two days. Collectively, Black-owned businesses have praised the new regulations.

PPP Round 3 Launches, Prioritizing Minority-Owned Businesses

“I believe providing resources to those who were unable to access funding during the initial Paycheck Protection Program rounds can still help save businesses,” said Efrem Yates, owner and operator of two Your Pie pizza restaurants in North Carolina. “Historically, minority-owned businesses have seen less access to capital overall. For most, this is the first time they’ll receive any kind of external funding for their businesses, and it’s at a time when many still need it.”

Yates, who received CARES Act funding in 2020 has also continued to expand his business during the pandemic, opening a second restaurant location in Raleigh in August.

Businesses interested in a second PPP loan – or a ‘second draw’ must demonstrate a revenue decline of 25% in any quarter of 2020 over the corresponding quarter or submit tax returns showing the same percentage decline in 2020 over 2019.

“We opened shortly before the COVID-19 pandemic began in late 2019, and our first year of business was mostly during government shutdowns,” said Jay and Miketa Davis, owners of LuLu’s Maryland-style Chicken and Seafood in Charlotte, who just announced they will open their second location in April 2021. “While we were able to access CARES funding during the initial rounds, one of the major reasons we were able to maintain while so many restaurants were forced to close is because we’ve not relied on external funding in the past – in part due to the historical lack of capital given to minority-owned businesses,” the couple who self-funded their restaurant added.

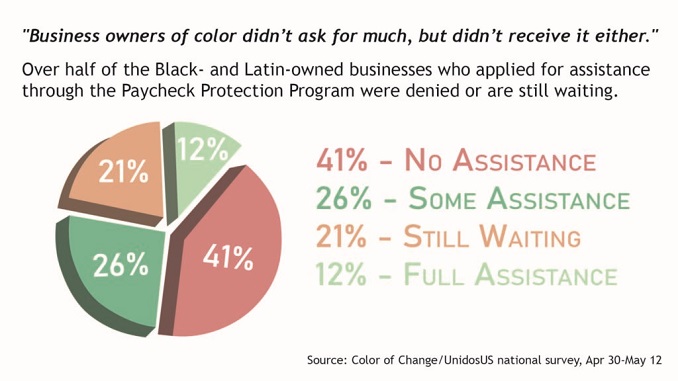

The new Paycheck Protection Program comes after a new $900 billion COVID relief package with $285 billion earmarked for forgivable PPP funding. CFIs can submit loan applications for first-time borrowers during the exclusive application period, while business owners interested in secondary PPP loans through these institutions can begin applying on Wednesday, Jan. 13. The program will then expand to participating lenders throughout the week. The change comes amid complaints the minority business owners received less access to funding during the initial PPP rounds.

Read Also: 3 Tips To Improve Your Restaurant For The New Normal – F & B

The third round of PPP will continue through March 31, 2021. The first two rounds of the Paycheck Protection Program in 2020 provided $525 billion in loans.