Franchise Equity Partners (“FEP” or the “Firm”), an independent and newly established private investment firm, today announced its official launch as a portfolio company of investment funds managed by HPS Investment Partners, LLC (“HPS”). HPS is a leading global alternative investment firm with over $75 billion of assets under management.

Franchise Equity Partners Launches

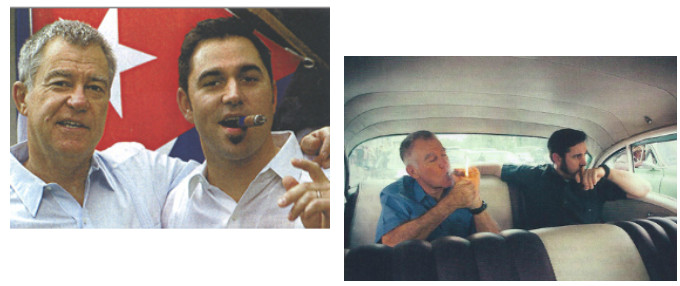

FEP will focus on partnering with successful owner operators across the U.S. franchising sector with an initial target portfolio size of $1 billion. The Firm is led by Co-Founders and Managing Partners Michael Esposito and Scott Romanoff. Messrs. Esposito and Romanoff are both retired partners from Goldman Sachs and previously worked together at the firm for more than 28 years.

FEP will make passive, permanent, minority equity investments alongside established and scaled owner-operators across the U.S. franchise ecosystem spanning an array of industry verticals, including restaurants, automotive dealerships, beverage distributors, heavy machinery, and other consumer and business services including health, beauty and fitness. Thanks in part to substantial backing from our investor group the Firm is strategically positioned to structure and execute permanent, flexible investments that are tailored to the diverse needs of U.S. franchise owner-operators who may be seeking to pursue organic and inorganic growth or diversification strategies, or to assist in estate planning and other shareholder dispositions.

“The U.S. franchising sector is an important, growing and attractive portion of our economy that we believe is currently underserved in terms of financial equity-based options suited to the unique financial and strategic goals of its operators,” said Michael Esposito. “Our bespoke approach, creativity and extensive investment experience, coupled with our strong capitalization, allow us to focus on the individual needs of entrepreneurs we invest alongside to help them meet and exceed their business objectives. Importantly, our capital and returns will be fully aligned with the success of our partners.”

Scott Romanoff, added, “We established FEP to address the equity capital needs of established U.S. franchisees. Ranging from growth to diversification to generational transfers and recapitalizations, we are committed to serving as a strategic financial and business partner to this community and to providing dependable and flexible permanent capital. We are very excited about what the future holds for us here at FEP as we pursue this unique and compelling opportunity.”

Messrs. Esposito and Romanoff retired from their respective positions at Goldman Sachs in 2020. Mr. Esposito was previously Chairman of the Global Financial Institutions Group at the firm and Mr. Romanoff held a range of positions within the firm’s Investment Banking Division and the Executive Office, including Head of Corporate Development and Co-Head of the Financial Institutions Financing Group.

Messrs. Esposito and Romanoff will be joined at FEP by a group of Operating Partners who possess deep experience in their respective industries and whose differentiated expertise will drive business impact and meaningful value for the firm’s portfolio companies. The executives include:

- Robert Daniel, Partner, Restaurant Vertical: Mr. Daniel comes to the Firm with more than 20- years of experience providing capital to the restaurant sector. He was most recently the Group Head of the Restaurant Banking Group at Regions Financial Corporation and previously held leadership positions at GE Capital, Franchise Finance and in the Restaurant Finance Group at Bank of America. Throughout his long and successful career, Mr. Daniel has successfully led and structured numerous transactions, including large syndicated deals, structured sale leasebacks, dividend recaps, and traditional M&A for franchisees, franchisors and operating companies.

- Mark LaNeve, Partner and Chairman, Automotive Vertical: Mr. LaNeve joins FEP following an extensive career in the automotive industry, including during which he served as President of Volvo NA and Vice President of Sales and Marketing for both General Motors and Ford. He also previously served as Chief Marketing Officer and Head of Agent Relations for Allstate Insurance Company.

- Don Reese, Partner and CEO, Automotive Vertical: Mr. Reese comes to FEP following a 34-year career in automotive retail and finance that included most recently serving as President and Chief Executive Officer of DriveTime, where he oversaw more than 125 dealerships and managed a $4.5 billion loan portfolio. He continues to serve as a director of the company. Mr. Reese previously held senior roles at leading dealership organizations, including Sheehy Auto Stores, Gurley Leep Automotive, and AutoNation, which he joined following its acquisition of Maroone Auto Group, where he was a senior executive and helped lead its sale to AutoNation.

- Enrico DiGirolamo, Senior Advisor: Mr. DiGirolamo is a Board Member for II VI Incorporated, an Operating Partner for AFI Partners, and is Chair of GTS software. Prior to that, Mr. DiGirolamo served as Chief Financial Officer of Covisint and a Senior Vice President for Allstate where he specialized in nationwide agency management. Earlier in his career, he served as Vice President and Chief Financial Officer for GM in Europe and he held a variety of senior executive positions throughout the corporation over the course of more than 30-years, including President of Motors Holding.

FEP is currently actively reviewing multiple transactions across its target verticals and looks forward to engaging with established and scaled operators across the United States.

Read Also: Emeril Lagasse Foundation Sets Record for Children’s Charities

About Franchise Equity Partners:

Franchise Equity Partners is a private investment firm specializing in providing capital to franchise businesses and their owners. Its differentiated approach combines extensive corporate finance and operating experience with passive, permanent capital to enable growth, ownership simplification, succession and estate planning, among other strategic business opportunities. To learn more about Franchise Equity Partners, please visit www.fep-us.com or follow the firm on LinkedIn.