The bottom fell out, of course, on many U.S. consumer spending categories during the month of March. But others, like grocery, drug and discount retailers, actually climbed significantly last month as consumers cooked at home and stocked up their pantries and medicine cabinets for an extended stretch of sheltering in place. Meanwhile, consumers were doing much more of their shopping online, as online sales climbed dramatically faster than in-store sales in virtually every retail category.

Discount Stores and Drug Stores See Growth in Payment Card Sales

Commerce Signals, a Verisk Financial company and leading source of U.S. retail payment insights, has analyzed the impact of Covid-19 on a variety of B2C companies and categories during the first quarter of 2020. The analysis leverages anonymized consumer credit and debit spending behavior dataset that includes 40 million U.S. households. Those insights, which are the most extensive and in-depth in the industry, highlight the dramatic impact the virus has had on a wide range of consumer-facing businesses.

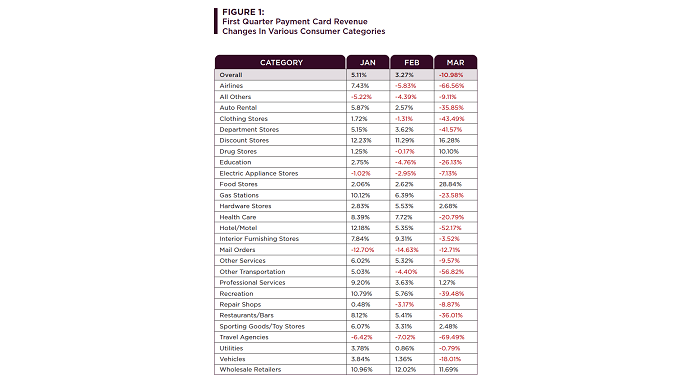

The hardest hit categories were in travel, hospitality, and restaurants. Compared to the same period a year earlier, card payments in March to Airlines were down 66.6 percent; Hotels and Motels, 52.2 percent; Auto Rental, 35.9 percent, Other Transportation, 56.8 percent; and Travel Agencies, 69.5 percent. Restaurants and Bars were down 36.0 percent in March, compared with March of 2019. (See Figure 1)

STRATEGIC BRIEFCOVID-19 BUYING BEHAVIOR

Also hard hit were department stores (down 41.6 percent), clothing stores (down 43.5 percent), and recreation (down 39.5 percent).

But there were winners as well. Grocery stores saw payment card sales climb by 28.8 percent during March, compared to a year earlier. Discount or mass merchant stores, including names like Walmart and Target, were up 16.3 percent, and drug stores grew payment card sales by 10.1 percent. Hardware store card revenues were up 2.7 percent. Wholesale retail, which includes Club stores and Amazon, was up 11.7 percent in March, as compared to the same period of 2019.

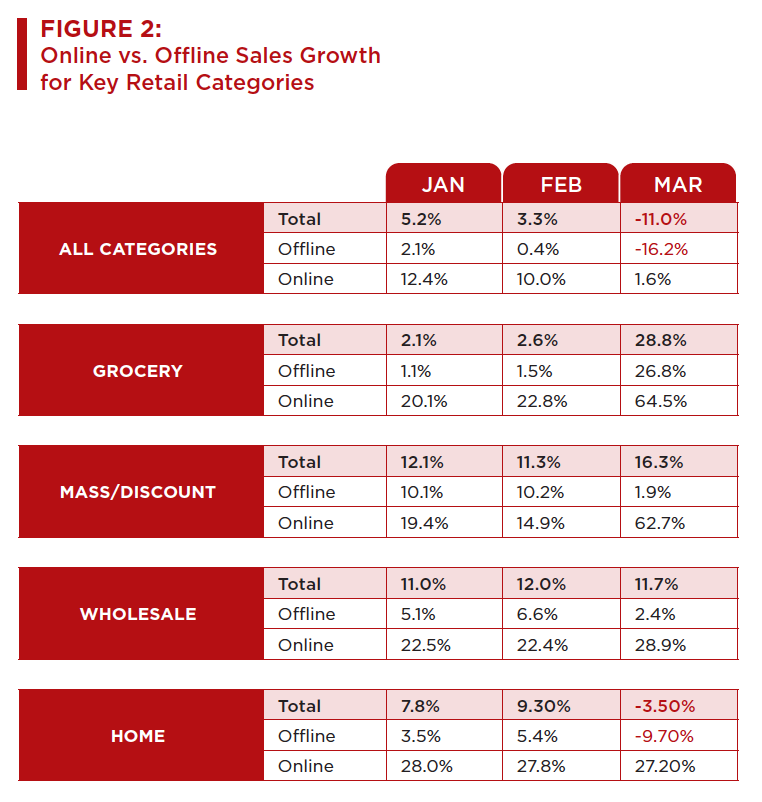

Online sales in these growing retail categories all increased faster than in-store payments. For example, in-store grocery sales were up 26.8 in March, compared to a year ago, while online grocery sales grew 64.5 percent in the same year to year comparison. In-store card payments to discount/mass merchant retailers climbed just 1.9 percent for March, but on-line payments jumped 62.7 percent. In the last week of March, in-store payments to discount/mass merchant retailers fell 24.8 percent compared to a year earlier, while payments for online sale climbed a whopping 121.3 percent. (See Figure 2.) In other retail categories that declined during March, online sales fell much less than in-store payments and in some cases grew compared to the same period in 2019.

Read Also: Key Tips for Restaurant Owners in Reopening Phases – F & B

A week-to-week analysis of payment card data shows how the impact of Covid-19 began to take hold in February and then grew precipitously during March. For example, card payments to Airlines were down 2.7 percent and 2.1 percent during the first two weeks of February. In the second and third weeks of March, payments were down 58.3 percent and 91.6 percent, respectively. Payments to Hotels and Motels were up by 10.0 percent and 10.1 percent during the first two weeks of February. However, by the second and third weeks of March, payments were down 37.9 percent and 91.1 percent, respectively.

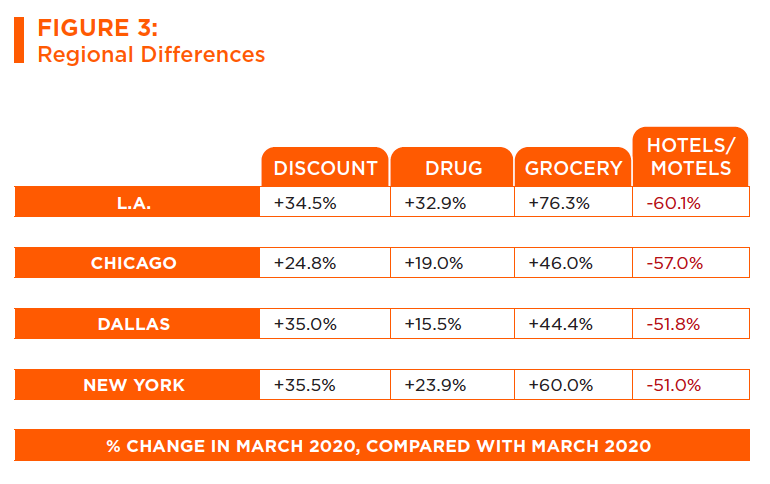

Commerce Signals also conducted analysis of Covid-19’s impact on consumer spending in major cities across the United States. Among regional differences, grocery, discount and drug store sales increases were significantly greater in Los Angeles than in Chicago, Dallas and New York. However, the decline in Hotel and Motel revenue was greater in L.A. than in those other cities. (See Figure 3)

ABOUT COMMERCE SIGNALS Commerce Signals, a Verisk Financial company, is a leading source of U.S. retail payment insights and analytics. The company has a unique, continuous and anonymized view of the credit and debit card spending behavior from 40 million U.S. households. Commerce Signals offers retailers and other direct-to-consumer companies powerful insights to understand customer and competitive dynamics outside their business, improve decision making, and increase marketing spend efficiency. Its insights and measurement solutions are used by some of the largest retailers in the country.

ABOUT COMMERCE SIGNALS Commerce Signals, a Verisk Financial company, is a leading source of U.S. retail payment insights and analytics. The company has a unique, continuous and anonymized view of the credit and debit card spending behavior from 40 million U.S. households. Commerce Signals offers retailers and other direct-to-consumer companies powerful insights to understand customer and competitive dynamics outside their business, improve decision making, and increase marketing spend efficiency. Its insights and measurement solutions are used by some of the largest retailers in the country.

ABOUT VERISK FINANCIAL Verisk (Nasdaq:VRSK) is a leading data analytics provider serving customers in insurance, energy and specialized markets, and financial services. Using advanced technologies to collect and analyze billions of records, Verisk draws on unique data assets and deep domain expertise to provide first-to-market innovations that are integrated into customer workflows. Verisk offers predictive analytics and decision support solutions to customers in rating, underwriting, claims, catastrophe and weather risk, global risk analytics, natural resources intelligence, economic forecasting, and many other fields. Around the world, Verisk helps customers protect people, property, and financial assets.

Headquartered in Jersey City, N.J., Verisk operates in 30 countries and is a member of Standard & Poor’s S&P 500® Index. In 2018, Forbes magazine named Verisk to its World’s Best Employers list. For more information, please visit www.verisk.com.